|

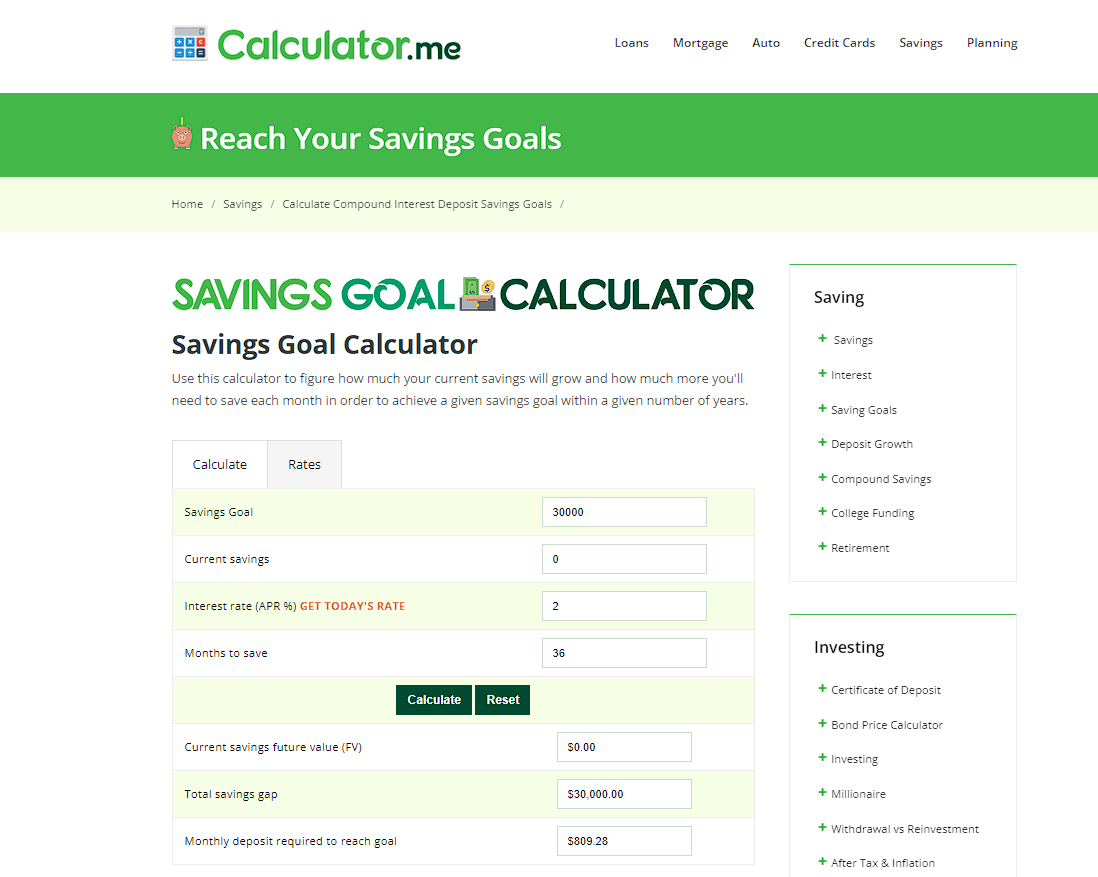

|How often do you find yourself daydreaming about a goal you have for your future? Maybe it's to own your own home, finally travel to that country on the top of your bucket list, or buy a home gym so that you can focus on your physical health. The feeling of accomplishing that goal can feel great, however the steps to take to get to the finish line can sometimes feel daunting. One crucial factor to achieving these goals is to save money. It's true that this can be 'easier said than done', but creating sinking funds with automated fund deposits can be immensely helpful for achieving your dreams. In this article, we will learn more about sinking funds, how to set plan and set these up, and the psychology behind why this method of saving can work for just about anyone. Please note: This collaborative article does not contain healthcare, therapeutic or financial advice. If you are concerned about your health or well-being, speak with a health professional or visit your nearest medical facility in an emergency. The links in this article may be affiliate links that I will be compensated for at no additional cost to you. What is a sinking fund? A sinking fund is considered a method of saving which relies on setting aside a certain amount of money to use for a specific reason at a later date. A sinking fund differs from savings because there is an intended purpose or goal in mind for the fund which is collected within a certain timeframe. For example, if your dream is to own a home and the sinking fund you want to create is a down payment fund to purchase a home, you would first decide how much you need in your fund to complete this goal. For this exercise, let's say you need $20,000. Your timeline is to have this sinking fund complete in 3 years (or 36 months). In order to find out how much you need to save per month, take the total amount you need to have in your fund and divide it by the number of months to match your timeline. $30,000 % 36 months = $833.33 / per month For this example, you would have your fully funded down payment in 3 years by saving $833.33 per month (not including interest). You can always adjust the timeline if you want to save quickly or take longer to have your completed fund in place. Financial calculators can be very helpful for setting up a sinking fund, as you can try out different scenarios and timelines to discover the best way to set up a sinking fund based on your current financial situation, or make adjustment if your situation changes in the future. And you can see how interest accruing while you save your funds can adjust the amount required to save on a monthly basis, as well. Where should you keep the funds? There are many options of savings accounts to keep your sinking funds while you contribute. If your timeline is shorter (one year or less) you may want to consider keeping these funds in a high-yield savings account that can be accessed at any time. For longer timeline goals, you may consider locking into other account with even higher returns. Speak to your financial institution (or shop around) to find the account that works the best for you. You can also have more than one sinking fund at a time, and with different timelines. The key feature of the account you decide to store your sinking fund in is that it needs to be a separate account from others, so that this money is earmarked and stored until the end of the timeline for your specific goal. If possible, name the account as the goal in mind, and you can see your fund grow over time until you get to the finish line. Related: Surprising Facts About Financial Well-Being & Mental Health Why do sinking funds work? The psychology behind why sinking funds work better than a regular savings account centers around the planning aspect of this financial method. Instead of throwing your money into one savings account and then deciding what to do with it, or purchasing items on credit cards or through loans, the idea of sinking funds is that you are preparing ahead of time for a purchase. This also means you will be avoiding interest rates or fees, because you the funds you are using are all yours. Another reason this method of savings can work well is that you can literally 'set it and forget it'. Most financial institutions offer easy ways of setting up transfers between accounts. So you can go ahead and set the amount and take (eg. every pay cheque) and so the method is completely automated. You might even forget about the fund for awhile and open your bank account a few months later and be astonished at how much you have saved without even thinking about it. I personally have used this method of saving and found that it has helped me reach a few important milestones in my life. Currently I have 6 sinking funds on the go, including working on a fully funded emergency fund as well as a vacation, wedding, and basement fund. Sinking funds have been a game changer in my own financial world and I hope this information helps you to be more informed on how you can take control of your finances and start saving to make your dreams a reality, too. Related: Fun Ways To Plan For Your Financial Future The links on this page may be embedded with affiliate links that I am compensated for at no additional cost to you.

Comments are closed.

|

Welcome to the blog!↓ That's me, Heather. :)

MENTAL HEALTH RESOURCE VAULTGreat!Check your email for instructions on how to access the Mental Health Resource Vault. Categories

All

Popular Posts// 25 Positive Mindset Quotes

// Self-Care Bullet Journal Spreads // 7 Ways Your Physical Health is Connected to Your Mental Health |

RSS Feed

RSS Feed