|

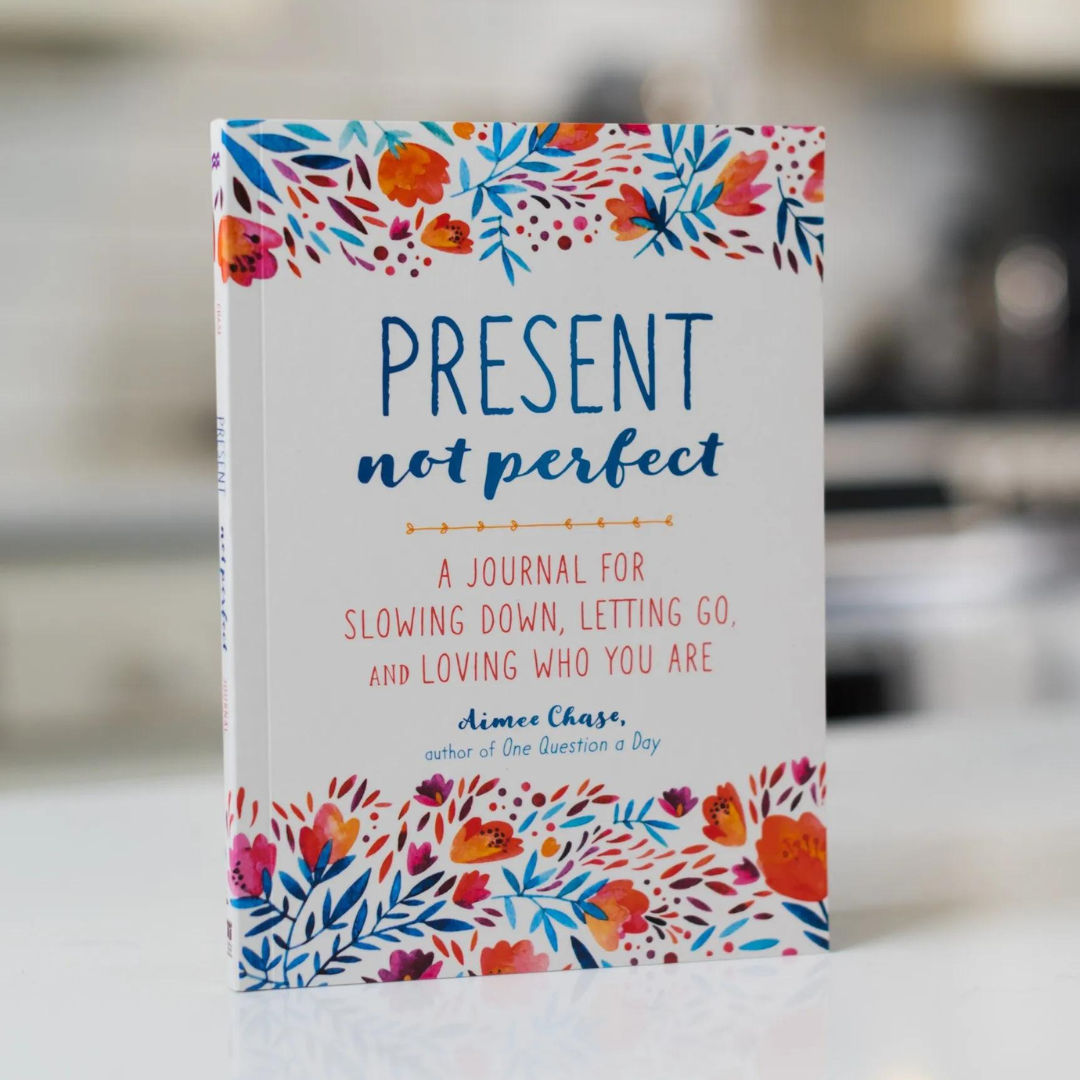

|Thinking about and planning your financial future may seem like it would be boring or a task that you would want to do on a rainy day, but actually financial planning can be enjoyable and even fun. Automating savings and considering retirement plans can also ease any stress or worry you may have about your future. Although many of us may become an ostrich and stick our head in the sands (metaphorically speaking) about finances, it can actually be quite important to consider what we want our financial futures to look like, and planning ahead can help achieve the goals you want to work towards. With the right mindset, you can make goals and plans for the future without feeling like it's a chore. Let's explore fun ways to plan for your financial future in this article. Please note: This collaborative article does not contain healthcare, therapeutic or financial advice. If you are concerned about your health or well-being, speak with a health professional or visit your nearest medical facility in an emergency. The links in this article may be affiliate links that I will be compensated for at no additional cost to you. Reflective Practices One of the first ways we can make financial planning more fun is to take away any numbers or math equations. In the beginning stages of financial planning, all you need is to be able to look inside and ask some questions of yourself. Reflective practices can help us understand ourselves, our actions, and our needs better, by asking some insightful questions. "Reflective practice is the ability to reflect on one's actions so as to engage in a process of continuous learning." All you need is a pen and paper, or a digital notepad - or, if you're more of a visual learner and observer, you could even choose to use creative tools to reflect, such as painting or drawing. Having some reflective prompts can also help the process, so here are some examples you may want to consider as you are thinking about your financial future: - How do I feel about my current financial picture? - What are my three key 'wants' for my financial future? - What can I learn from my past financial successes or mistakes? - I wonder what would happen if all of my financial plans for the future came true? - What do I need to know more about in order to plan for my future? - How do I feel right now in this moment as I consider my financial future? What other reflective questions do you have for yourself? Consider your unique situation and ask the tough questions. You might be surprised with how interesting this process is and what you uncover! Digital Tools Now that you have an idea of what you want for your financial future, it's time to consider some goals and steps to get to the finish line. One of the best ways to take the stress and confusion out of planning our financial future is to use technology. You don't have to be a mathematician to plan your goals - use technology like online calculators to do all the heavy lifting of those math equations for you. For example, let's consider that you have decided you want to save for a house. This may seem like a daunting idea if you are a first time homebuyer, but it can actually be fun to start the process of considering what type of house you want to buy, including the location and features it could have. You can also plan on how much or how long you would like to save for, depending on your current financial situation. Another financial plan that can feel daunting and a lot of people put off planning for a long time is retirement planning. It's interesting because retirement is something that most people look towards, but the path to planning and achieving the retirement that you want to have can be a bit of a mystery. Make it fun by using an online retirement planning calculator that also accounts for inflation. Take the guess work out of planning for your future and not only can you breath a sigh of relief, but also have fun seeing all the calculations instantly done for you. Play Finance Games One of the best ways to have fun in any situation is to play games. There are tons of money-related board or card games that you can make a night of it by inviting over your friends or family and having a laugh together. Not only can this increase your happiness levels by being social with others, but it can also help you to consider financial moves for your future. For example, Monopoly is a board game that most people are familiar with, and it can help you consider buying, selling and trading properties. You also need to count your money and consider your risk tolerance for purchases. All while having fun! There are also board games by popular financial moguls like Dave Ramsey who has a lot of great resources for getting out of debt and taking the baby-steps to financial freedom. As you can see, financial planning doesn't have to be boring and drab.. it can be fun and involve others. And when in doubt, always consult a financial professional who can help set you on a path of success. You don't have to make these plans alone, and having the advice and support of others can be helpful in your journey towards the financial future that you want for yourself. The links on this page may be embedded with affiliate links that I am compensated for at no additional cost to you.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Welcome to the blog!↓ That's me, Heather. :)

MENTAL HEALTH RESOURCE VAULTGreat!Check your email for instructions on how to access the Mental Health Resource Vault. Categories

All

Popular Posts// 25 Positive Mindset Quotes

// Self-Care Bullet Journal Spreads // 7 Ways Your Physical Health is Connected to Your Mental Health |

RSS Feed

RSS Feed