|

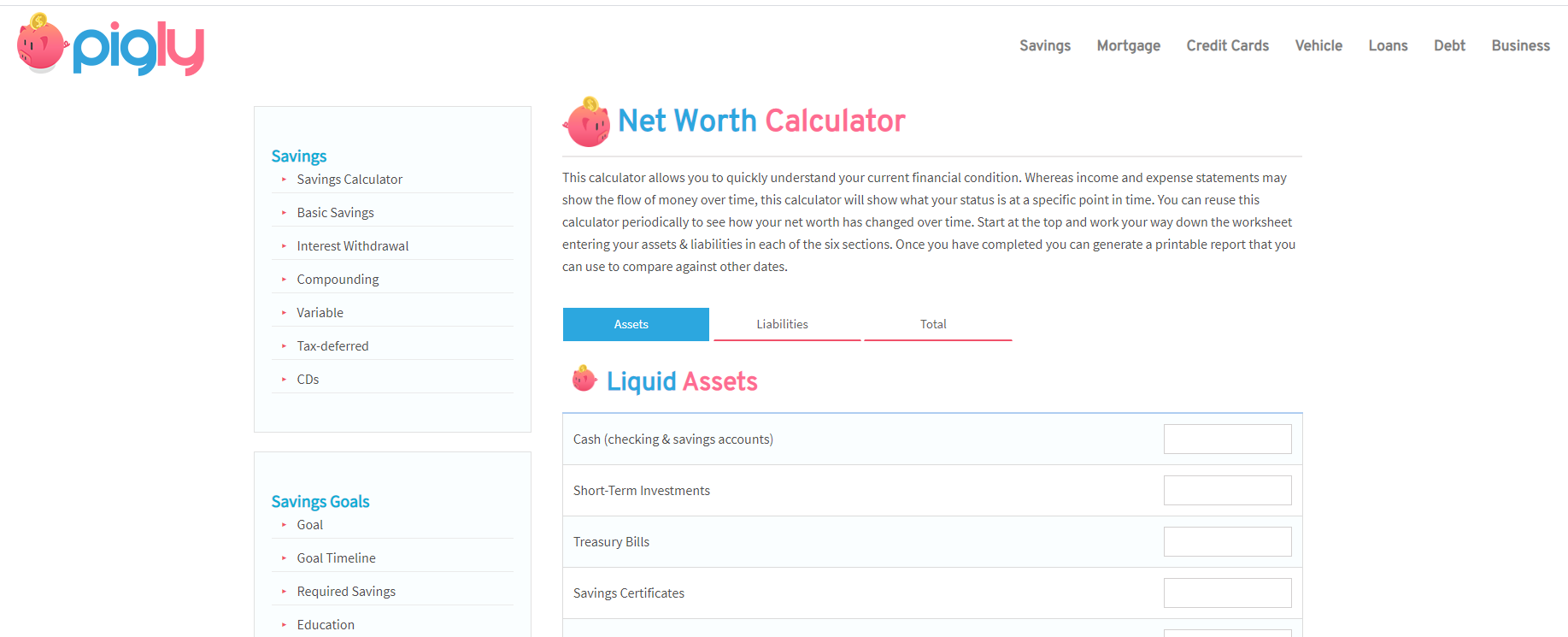

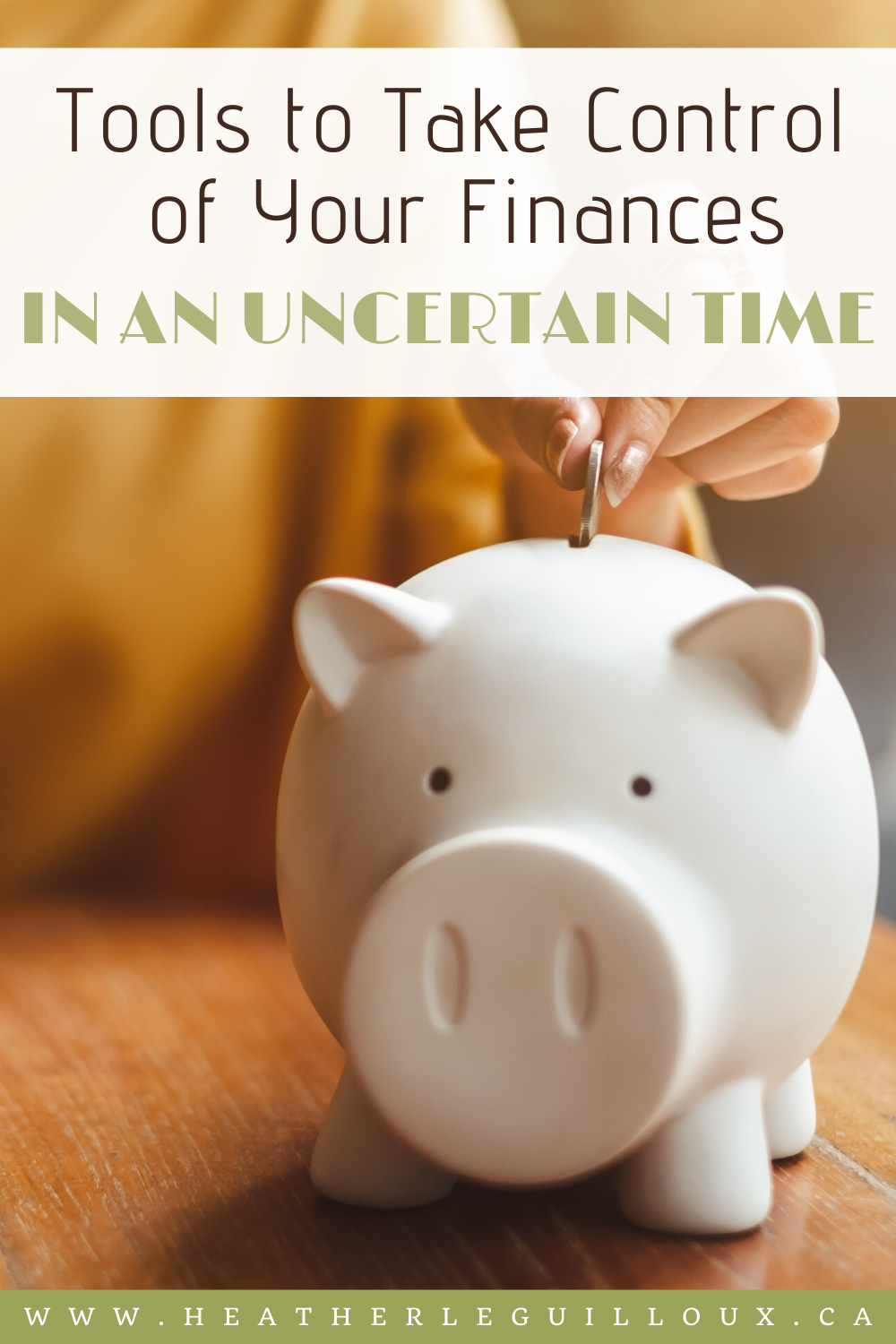

|Fact: A 2018 survey by the Federal Reserve indicated 40% of Americans would not be able to cover a $400 emergency. In Canada, household debt rose in the first quarter as the COVID-19 pandemic began to take hold of the economy. Statistics Canada reported that household credit market debt as a proportion of household disposable income rose to 176.9 per cent from 175.6 per cent. In other words, there was $1.77 in credit market debt for every dollar of household disposable income. There is no doubt that the pandemic that we are currently experiencing is having an enormous and potentially devastating impacts on economies and individual household finances across the globe. The domino-effect of financial stress can be felt deeply in our emotional and mental health by decreasing feelings of self-worth and increasing a sense of hopelessness. In a situation that may seem dire, there are tools and steps we can each take to take control of our finances which can improve our overall health and well-being, as well. With so much available in the tech world, you can even find fun ways of creating extra wealth and play games for real money. Continue reading to discover free financial tools and tips to guide you in this uncertain time. Please note: This article does not contain financial, healthcare or therapeutic advice. If you are concerned about your health or well-being, speak with a health professional or visit your nearest medical facility in an emergency. This is a collaborative article. Tools to Take Control of Your Finances |

Welcome to the blog!↓ That's me, Heather. :)

MENTAL HEALTH RESOURCE VAULTGreat!Check your email for instructions on how to access the Mental Health Resource Vault. Categories

All

Popular Posts// 25 Positive Mindset Quotes

// Self-Care Bullet Journal Spreads // 7 Ways Your Physical Health is Connected to Your Mental Health |

RSS Feed

RSS Feed