|

|As we are soon arriving at the end of another year, it can be a time of reflection and pause to consider the learning we can gather from our experiences and efforts over the previous 12 months. Sometimes this can be daunting, especially if it has been a particularly tough year for one reason or another, but it can also be indispensably helpful to bring what we have learned into a new year. One area of reflection that can be especially helpful is to look over our finances. However you personally feel about money, the bottom line is that we all need money to live, and so it can be important to have a snapshot of our financial well-being in order to know where we currently stand and where we would like to get to. Let's take a look at some tips on how to make the most of an end of year financial check-up. Please note: This collaborative article does not contain healthcare, therapeutic or financial advice. If you are concerned about your health or well-being, speak with a health professional or visit your nearest medical facility in an emergency. The links in this article may be affiliate links that I will be compensated for at no additional cost to you. Get Organized Everyone sets up their financial organization differently, depending on how you keep track this information. Perhaps you find spreadsheets or online accounting software helpful, or necessary, especially if you run a business. Or maybe you have more of a paper-and-pen kind of organization. The type of system you use to keep track of your finances is not the most important factor, rather just having a system that works for you is key. If you are currently dissatisfied with your organizational system or you are looking to try something new, consider these options:

As you are getting your finances organized, make sure you make note of all financial obligations you may have, even if it's a credit card you haven't used in months. Your financial check-up should have all the information you need so that you can see the big picture of your current financial picture. This may also include your spouse or common-laws information, if you work from a joint bank account or financial system. Determine Your Money Goals Take out a journal or blank piece of paper, or use an online word document, and start brainstorming your money goals. At first you may want to just brainstorm and write down anything that comes to mind, regardless of how achievable you feel they are. This is known as a brain dump and it can be very revealing to see what your core needs and wants are when it comes to your goals around finances. Next, ask yourself some reflection questions about how your past financial year, how you are feeling right now as your consider your finances, and what you would like to change, or keep doing, next year. Here are some example reflection questions from money coach and host of The Money Nerds Podcast, Whitney Hansen, for you to get started:

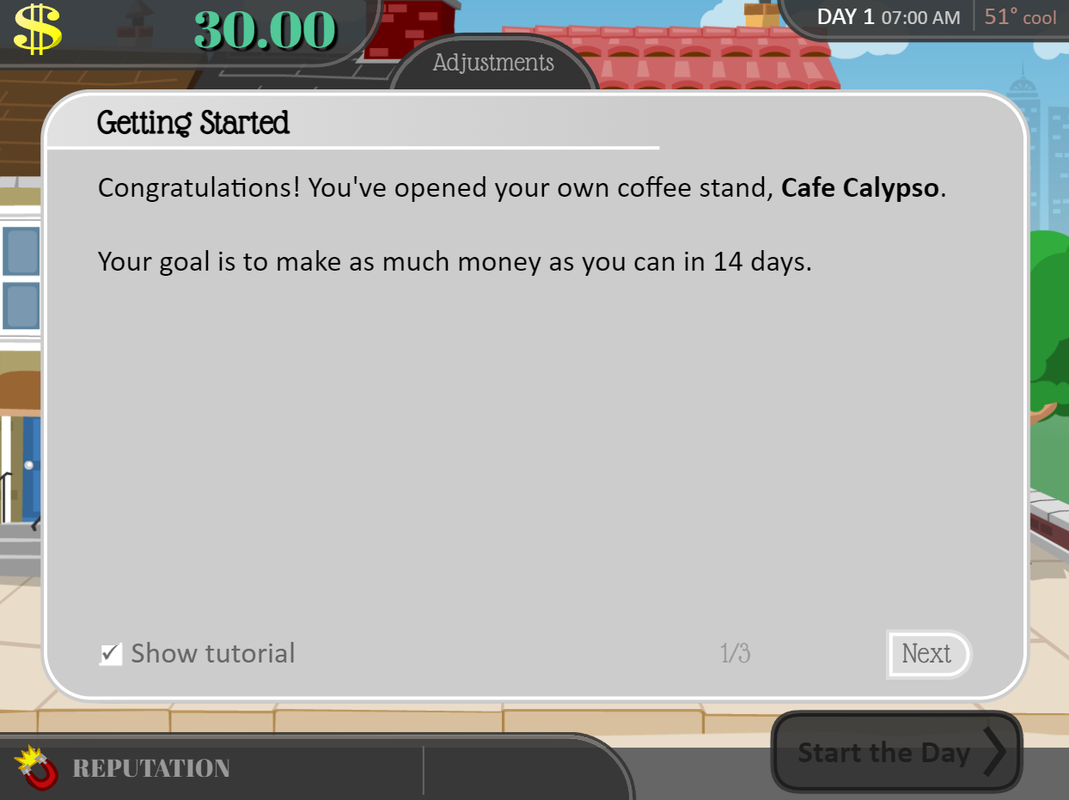

When you are writing down your money goals for next year, make sure your goals are created using the SMART method (Specific, Measurable, Achievable, Relevant, and Time-Bound) which can make these goals easier to work towards. Once you have created your goals, ensure you display these in a place you often view, for example, your computer desktop wallpaper, the first page of your journal or agenda, or above your workstation. Related: Your Mental Health And Money Relationship Take a Break Starring at spreadsheets and numbers can be exhausting, so it can be helpful to take breaks while you're going through your end of year financial check up. While you're still at your computer, you can take some time to unwind while staying in the finance mindset by playing fun money games that can not only teach you some basic financial skills, they can really challenge you to think outside the box in your own financial life. For example, if you have been considering opening a business, a fun game to play is coffee shop simulation. In this game, you have 14 days to make a profit, and there is a lot of variables to take into account, from the weather, which can have an impact on the likelihood of customers to purchase coffee or not, and also how strong or sweet your coffee is. You also need to make sure you don't run out of ingredients, otherwise you won't make any profit. Sounds easy, right? Give it a try! You might be surprised that, just like any business, there is a learning curve! Or maybe you have always dreamed of being a real estate investor, buying properties and flipping houses or business for a profit. Real Estate Tycoon let's you try on a real estate license for free so that you can try your hand at making a profit in this high stakes business. But be careful! You want to buy low and sell high, so make sure you time your purchases right so that you can meet your mission goal. These are just a few examples of fun and free games to play while you're taking a break from your financial end of your check up. Who said finances had to be boring? Practice Self-Compassion As you work through your end of your financial check-up, ensure that you are practicing self-compassion. Living in a world filled with constant reminders of consumerism (Is your inbox or table filled with flyers promoting sales and last chance offers like mine?) it can be difficult to ever feel like you're content with your current finances. Often we might feel like we need to make more money, spend more money on items or experiences, or reach for the stars when it comes to being financial secure. To combat this feeling of always needing more, it can be helpful to consider the work and effort you have already put in to get to where you are right now. Reminding yourself of what you have, rather than what you want. Honour the present moment and what it has taken for you to get to this place in life, and all of the experiences and teachings you have learned along the way. I wish you well in your end of year financial check-up and I hope you have a prosperous and happy new year! Related: All Finance-related blog articles The links on this page may be embedded with affiliate links that I am compensated for at no additional cost to you.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Welcome to the blog!↓ That's me, Heather. :)

MENTAL HEALTH RESOURCE VAULTGreat!Check your email for instructions on how to access the Mental Health Resource Vault. Categories

All

Popular Posts// 25 Positive Mindset Quotes

// Self-Care Bullet Journal Spreads // 7 Ways Your Physical Health is Connected to Your Mental Health |

RSS Feed

RSS Feed